Decent new issue calendar today:

Issuer Rating Size Mat Pricing

Scripps Networks Baa1/A- $500mm 5y T+180

National Fuel Gas Baa1/BBB $350mm 10y T+295

Pacific Gas & Electric A3/BBB+ $250mm 30y T+160

AGCO Corp-CoC,144a Ba1/BBB- $300mm 10y 5.875%

Tesco-CoC,144a A3/A- Bench 3y T+165-170

Tesco-CoC,144a A3/A- $ 5y T+180-185

Canadian Pac Railway Baa3/BBB- $500mm 10y T+275

Canadian Pac Railway Baa3/BBB- $ 30y T+300

DTE Energy-$25 Baa3/BBB- $150mm 50NC5 6.50%

The DTE's are junior subordinated debt ($25 par)where interest can be deferred for up to 20 quarters and callable at par in 2016.

You look at the spreads on the two energy companies and you realize that there is risk beyond their regulated subs (NFG does own timberlands).

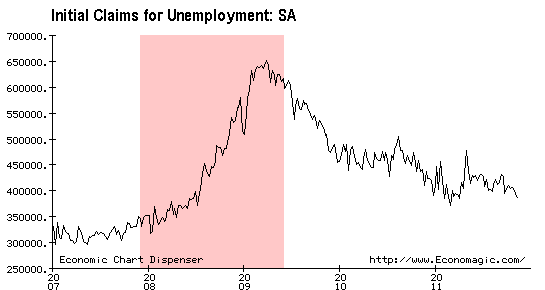

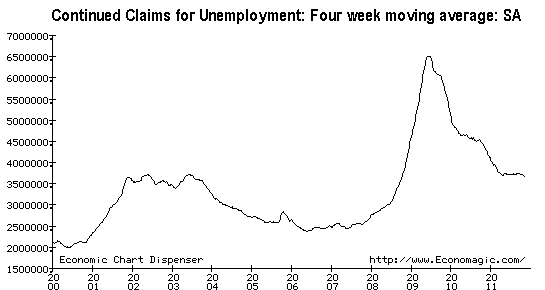

Breadth wasn't all that impressive in the credit markets today as Ig was decidedly negative, HY was almost flat and converts positive on small volume:

bottom line - don't like risk here. The deals brought today are interesting and have decent risk premiums, but I don't see out-performance here.