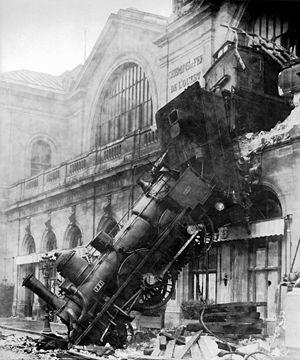

Europe's financial situation (sovereign and banks) is a trainwreck. There is no solution for the situation. It is too big, resources are too thin and political/economic idealogies are to far apart.

This morning the Daily Telegraph released a document sourced from the German government with suggestions for an EU treaty change. Contained within it:

The establishment of a procedure for an orderly default as part of the ESM:

For member states that are covered by an ESM programme, but despite complying with it are unable to achieve debt sustainability, the possibility of budgetary interventions is not sufficient. Therefore, there must also be the option of an orderly default in order to reduce the burden on taxpayers ( in the other eurozone states), and also to provide the affected country with an opportunity for a fresh start. In the present ESM Treaty the possible participation by private creditors through socalled "collective action clauses” (CACs) is not sufficient.

The ESM should consider the request made by a member state for relief loans against the criteria of debt sustainability. If this is negative, the affected member state would instead receive loans for a limited time only, during which the procedure for an orderly default would be prepared.

In order to make sovereign defaults possible where they are unavoidable, the threat of instability in the financial system resulting from such a default must be able to be credibly excluded. A plan to maintain the stability of the financial system in the event of an orderly default needs to be developed in close co-operation with European banking regulators. This would determine which banks would be restructured and/or recapitalised, which will necessitate the drawing up of Europewide rules on bank restructuring.

Document here: s3.documentcloud.org/documents/267781/brusselsembed.pdf

Germany sees the writing on the wall - sovereign defaults and the recapitalization of the banks. Prepare for the worst and hope for the best. It is not time to enter the fray with value eyes for there is only a value trap waiting. Liquidity is non-existant, buyers are gone and there is no plan. Continue to avoid European issues.

No comments:

Post a Comment