Lynas Corporation Limited is an Australia-based company. The Company principal activities during the fiscal year ended June 30, 2010 (fiscal 2010), were planning, design and construction of a concentration plant in Western Australia, and a materials processing plant in Malaysia for the production and distribution of Rare Earth Oxides; exploration and development of rare earths deposits, and exploration for other mineral resources. In December 2009, the Company completed an acquisition of rights relating to apatite at Mount Weld. The Company is a registered holder of all relevant tenements controlling all minerals rights within those tenements at Mount Weld. The Company’s subsidiaries include Lynas Malaysia Sdn Bhd, Lynas Services Pty Ltd, Mt Weld Holdings Pty Ltd, Mt Weld Rare Earths Pty Ltd and Mt Weld Mining Pty Ltd.

The trend is your friend - SIDELINES until trend reverses - opportunity to buy lower:

Company got a pop from the new rare earth metals ETF. Let it roll over a bit and enter lower. Look for max entry price of $1.30 - $1.35

Friday, October 29, 2010

Fund Flows - October 27, 2010

All Taxable Bonds saw total positive inflows of $4.2 billion, or (+0.4%) of assets. Ranking inflows YTD as a percentage of assets, EM Debt is first with $12.5 billion followed by Bank Loans with $11.2 billion and Global Debt $43.5 billion. Money markets saw positive inflows of $17.3 billion, or (+0.7%) of assets. Equities saw $5.2 billion in positive inflows, or (+0.2%). Money Markets have seen the greatest net outflows YTD of $437 billion, or (-13.6%) of assets.

The money flow into risk is somewhat disconcerting. The reach for yield is obvious in the fund flow tables as well as the focus on dividend producing equities. While rates are low (and will, most likely, stay this way for some time) the increase in risk appetite to feed the yield beast rarely, if ever, works out longer term. That said, flow (momentum) is on the side of risk, so catch a wave, ride returns, keep an eye on the risk trade and use stops.

I was talking with some sell-side friends yesterday and they mentioned that the demand for high yield continues unabated - deals are massively oversubscribed, allocations are severe and covenants getting light. Don't like it, but have to buy the trade. HYB for at least a 5% allocation continues to be warranted.

The money flow into risk is somewhat disconcerting. The reach for yield is obvious in the fund flow tables as well as the focus on dividend producing equities. While rates are low (and will, most likely, stay this way for some time) the increase in risk appetite to feed the yield beast rarely, if ever, works out longer term. That said, flow (momentum) is on the side of risk, so catch a wave, ride returns, keep an eye on the risk trade and use stops.

I was talking with some sell-side friends yesterday and they mentioned that the demand for high yield continues unabated - deals are massively oversubscribed, allocations are severe and covenants getting light. Don't like it, but have to buy the trade. HYB for at least a 5% allocation continues to be warranted.

Thursday, October 28, 2010

Wednesday, October 27, 2010

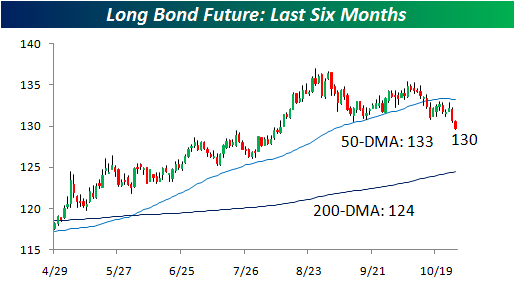

Treasuries - Yes, There Will be Blood

Govvies getting whacked as QE2 becomes QE2 lite. You know the market is on shaky ground when everyone is relying on the Fed to support their positions. Since QE2 lite rumors started surfacing, this is what we have seen:

Ouch.

The 10 year:

Oh boy, look out below!

How about the curve:

Belly gets whacked going through auctions.

Get shorty:

Ouch.

The 10 year:

Oh boy, look out below!

How about the curve:

Belly gets whacked going through auctions.

Get shorty:

Chrysler Arbs the Government

On the wire (abridged):

Chrysler will soon get new federal loans to help retool factories to make more fuel efficient vehicles, according to sources familiar with the matter.

The timing of the Energy Department award to Chrysler is fluid, but sources with knowledge of the financing and the industry say the automaker will likely receive approval for new credit before General Motors Co GM.UL.

For Chrysler specifically, Energy Department financing would improve cash flow and enable it to accelerate payment of some $7 billion in pricey government loans extended as part of bankruptcy. Terms are steep for Treasury financing as lender of last resort. According to its August financial update, Chrysler still owes the Treasury $5.7 billion. The interest rates on that debt range from 7.22 percent to 14.33 percent.Gotta love this. Chrysler (Fiat) is essentially arbing the government. Good times, good times.

Developers Diversified - Numbers Decent but Stay Higher in Cap Structure

Developers Diversified Realty Corp. said funds from operations amounted to $63.2 million, or 25 cents a share. Analysts polled by Thomson Reuters expected funds from operations of 24 cents a share. The company continues to be focused on regaining investment grade ratings by all the agencies, but there is significant work to do before this can happen. The company continues to execute on its plan to reduce leverage and increase the quality of its portfolio and is slightly ahead of expectations. NOI should continue to increase in 2011 and 2012 as space currently being negotiated and/or under LOI begins paying. End of the day, the story is improving and the portfolio is improving, but it will be some time before the company is investment grade.

Key Numbers and Stats:

Key Numbers and Stats:

- FFO for 3mo 9/10 (adjusted for $26mm of charges) was $63.2MM. FFO for 9mo '10 (adjusted) was $193.4MM (adjusted for $160MM of charges).

- FFO for 3mo 9/10 (unadjusted) was $37.1MM (excluding preferred dividends) which compares to a FFO loss of $90.1MM for the prior-year comparable period.

- FFO for 9mo '10 (unadjusted) was $32.7MM which compares to a FFO loss of $116.6MM for the prior-year comparable period.

- Core portfolio leased rate increased to 92.0% at September 30, 2010 from 91.6% at June 30, 2010 and 90.9% at September 30, 200;

- Same Store Net Operating Income growth of 2.0% as compared to an increase of 1.5% in the second quarter of 2010 and a decrease of 4.1% in the third quarter of 2009;

- Gross PP&E fell by 4.3% since EOY '09 (down 6% on a net basis); Real estate holdings fell by 6.3% during the same period

- Total debt fell by over $240MM to $4.4B; Debt is down 15% since EOY '09, with the majority of the reduction in secured/mortgage debt;

Debt to Real-Estate Assets (<65%): 50%

Secured debt / Assets (<40%): 24%

Unencumbered assets / unsecured debt (>135%): 224%

Fixed Charge Coverage (1.5x): 1.7x

The company is well within their covenant levels and have enough headroom to continue managing their balance sheet.

Other Relevant information:

- During the quarter, the 25 assets owned by MV LLC were placed in the control of a court appointed receiver and as a result, the entity that holds the assets and nonrecourse mortgage loan was deconsolidated. Upon deconsolidation, the Company recorded a gain of approximately $5.6 million because the carrying value of the nonrecourse debt exceeded the carrying value of the collateralized assets.

- YTD, DDR has activity on 75% of the space vacated by bankrupt retailers including 43% sold or lease, 11% at-lease and 21% in LOI negotiations.

- Brazil continues to outperform with a lease rate of 98%, same store NOI growth of 14% and positive spreads for new deals of 23% and positive spreads renewals of 16%.

- Last week DDR closed on the refinancing of our unsecured revolving credit facilities, which now have an aggregate capacity of just over $1 billion and a 40-month term that expires in February of 2014.

- From the call on credit ratings "our goal to the investment grade rated credit by all three rating agencies remains the top priority for this company. While we remain investment grade rated by Moody's and the requirements for an investment grade rating at Fitch and S&P are aspirational, we will continue to pursue prudent strategies that we believe will result in an eventual upgrade to our corporate credit and a continued reduction of our risk profile."

Guidance:

The Company continues to estimate operating FFO for the year of $1.00-$1.05 per diluted share.

Market reaction:

On the day of release, the equity was up, rolled over then recovered on the 26th and is currently down (with the market).

Bonds (20s) traced up about 2pts from prior trades.

Value:

DDR 9⅝ 16 Baa3/BB 115.00-117.00 5YR 508/468 480/439z. 5.888ytw

DDR 7½ 17 Baa3/BB 106.00-107.00 10YR 375/357 454/435z. 6.162ytw

DDR 7½ 18 Baa3 BB 104.00-105.00 10YR 423/406 471/455. 6.661

DDR 7⅞ 20 Baa3 BB 107.00-108.00 10YR 428/415 442/428. 6.746

KIM 4.3 18 Baa1 BBB+ 101.96-102.28 7YR 208/203 189/183. 3.936

KIM 6⅞ 19 Baa1 BBB+ 116.28-116.68 10YR 203/198 226/220. 4.576

REG 5⅞ 17 Baa2 BBB 109.62-109.92 10YR 160/155 229/224. 4.146

REG 6 20 Baa2 BBB 110.00-110.41 10YR 210/205 219/214. 4.646

DDR CDS: 295/315

KIM CDS: 140/150

I find the bonds compelling north of 450/z due to the strides the company has made in its "plan", the headroom under their covenants and the increased role their "prime" portfolio plays in the company. NOI gains in 2011 and 2012 should be further supportive of the credit.

Basis swaps are also compelling given the premium at which the CDS trade to cash.

Preferreds are interesting, but not overly compelling at these prices (although Gs have underperformed the Hs and Is and might be worth a look relative to the others).

Don't find equity all that compelling at these prices and believe the NOI gains and portfolio improvement are baked into the cake.

Bottom line: Staying higher in the capital structure.

Disclosure: Long DDR preferreds.

Tuesday, October 26, 2010

Pennsylvania Moritorium On Shale Gas!

On the wire:

Watch how Nat Gas opens tomorrow, if it opens strong, think of it from the short side. As is typical, the headline will make its way around, but not the body of the article. This is a strategic political play, nothing more. Sell to the greater fool, should he show up.

HARRISBURG, Pa. - The governor of Pennsylvania has ordered a halt to new natural gas developments on state forest lands.

The Democratic governor's office said Monday that Gov. Edward Rendell would sign what was described as a "strategic moratorium" so Republicans, who control the state senate, would resume negotiations over a prospective tax on drilling.

He proclaimed the tax proposal dead last week, blaming legislative Republicans for what he described as their failure to offer a reasonable compromise on the rate — one of multiple issues that have stalled progress.

Less than a year ago, the state Department of Conservation and Natural Resources announced it was making nearly 13,000 hectares of state forest land available for leasing by gas drilling companies.

The Marcellus Shale region, a rock bed about beneath New York, Pennsylvania, West Virginia and Ohio, has produced a rush of exploration and land deals in the state, and could become the most valuable natural gas field in the United States.

Its production employs a process known as hydraulic fracturing, in which water and chemicals are pumped underground to create fissures in the rock and release the gas.

Watch how Nat Gas opens tomorrow, if it opens strong, think of it from the short side. As is typical, the headline will make its way around, but not the body of the article. This is a strategic political play, nothing more. Sell to the greater fool, should he show up.

Airgas - Bonds Attractive at Current Levels

Airgas (Baa3/BBB) announced earnings this morning that were pretty much in line with expectations. EPS, excluding items, came in at $0.83 on sales of $1.06 billion. That beat estimates on EPS by a penny and hit revenue right on the nose. Looking at the credit metrics, the company appears solid for their credit rating and the numbers were decent.

ARG 15s have COC language, which is helpful if the notes cease to be rated Investment Grade by each of the Rating Agencies, but as APDs ratings are A3/A and unlikely yo go below investment grade in the event of a takeover, we will, for the time being, ignore the covenant. The bonds currently trace at $101.369 to yield 2.944% or +175/5yr. At these levels, the bonds are attractive as downside is traveling to APD where the 13s currently trade +85. Given the current trading levels, I would overweight the name as spreads could go tighter once an outcome is known.

ARG 3.25% 10/15 (Baa3/BBB) +175/5yr

PX 3.25% 9/15 (A2/A) +55/5yr

APD 4.15% 02/13 (A3/A) +85/3yr

Relevant Numbers:

ARG 15s have COC language, which is helpful if the notes cease to be rated Investment Grade by each of the Rating Agencies, but as APDs ratings are A3/A and unlikely yo go below investment grade in the event of a takeover, we will, for the time being, ignore the covenant. The bonds currently trace at $101.369 to yield 2.944% or +175/5yr. At these levels, the bonds are attractive as downside is traveling to APD where the 13s currently trade +85. Given the current trading levels, I would overweight the name as spreads could go tighter once an outcome is known.

ARG 3.25% 10/15 (Baa3/BBB) +175/5yr

PX 3.25% 9/15 (A2/A) +55/5yr

APD 4.15% 02/13 (A3/A) +85/3yr

Relevant Numbers:

- Sales up 10% YOY to $1,061MM;

- Same store sales +9%

- Operating income up 10.9% YOY to $121.8MM;

- SD&A was 37% of sales (vs 38% 9/09), reducing the margin by 100bps;

- Cost of products sol was up 12% YOY;

- Company just replaced D&A during the 6 month period;

- Debt up 11% vs YE 3/10. Adjusted for trade recv, debt was down 7%;

- Adjusted Cash from Operations fell 16% from 6mo end 9/09 to $290MM

- Free Cash Flow was $133MM for 6mo ending 9/10 (down 24% from same period '09);

- Adjusted Debt to Capitalization is 41.7%, down from 45.6% at 3/31/10.

Company Guidance:

“Given our strong performance and expectations for steady growth, we raised our fiscal 2011 guidance, which now represents a year-over-year increase of 24% to 28% in underlying earnings before SAP costs,”. As stated earlier, guidance is in-line with estimates.

Market Impact:

- ARG 15s haven't traced since 10/25, at which time they were down approximately 1/2 point from earlier prints. ARG 13s are wider on the day.

- Equity is currently trading at $70.80 +1% on the day. (at 28x P/E, which is about 9 higher than APD or PX and a forward P/E of 21x - quite frankly, I don't see their argument for APD's offer grossly undervaluing the company unless they are expecting significant margin expansion).

US Steel - Lower Entry Points for Bonds Ahead

US Steel (X - Ba2/BB) results:

US Steel's Q3 '10 earnings reflected sequential declines in production, shipments and average realized prices (more of the same expected in Q4 '10). The company ran negative working capital of over $500MM, leading to continued negative free cash flow of nearly $1B. X is the most recent to provide a somewhat weaker outlook for the industry and we should not expect the company's credit fundamentals to improve in the near to intermediate term. Should the company continue to be a net consumer of cash, I believe that their current ratings are at risk for downgrade. I am underweight the sector.

Bottom line stats:

FCF: -$926MM

Total Debt: $3,659MM up $300MM this year.

CFO YTD: -$478MM

CFO Capex coverage: N/A (cash USED in operations)

Debt/Capitalization: +300bps from 12/09 to 44.7%

Headline Numbers:

US Steel's Q3 '10 earnings reflected sequential declines in production, shipments and average realized prices (more of the same expected in Q4 '10). The company ran negative working capital of over $500MM, leading to continued negative free cash flow of nearly $1B. X is the most recent to provide a somewhat weaker outlook for the industry and we should not expect the company's credit fundamentals to improve in the near to intermediate term. Should the company continue to be a net consumer of cash, I believe that their current ratings are at risk for downgrade. I am underweight the sector.

Bottom line stats:

FCF: -$926MM

Total Debt: $3,659MM up $300MM this year.

CFO YTD: -$478MM

CFO Capex coverage: N/A (cash USED in operations)

Debt/Capitalization: +300bps from 12/09 to 44.7%

Headline Numbers:

- Net sales of $4.5 billion -4% from Q2 '10;

- Loss from operations of $138MM;

- Net loss of $51MM for Q3, down $26MM sequentiall and up $252MM YOY. Net income was propped up by currency gains of $139MM (second quarter loss was due to currency losses);

- Cash used in operations: -$478MM (9mo), capex: $426MM, dividends: $22MM. Negative free cash flow of $926MM.

- U. S. Steel had $643MM of cash and $2.2B of total liquidity as compared to $947MM of cash and $2.5B of total liquidity at June 30, 2010.

Segment Results:

- Flat Rolled: Q3 loss of $174MM, down $272MM sequentially and up $204MM YOY.

- Loss due to decreased shipments (-6% to 3.8mm tons) and production volumes, decreased average realized prices ($688/net ton, -$12 from Q2), increased costs for facility repair and maintenance, and consumption of higher cost coal, coke and iron ore purchased to support earlier facility restarts. Capacity stood at 77% (down from 82%).

- USS Europe: Q3 loss of $25MM, down $44MM sequentially and down $32MM YOY

- Favorable currency transactions offset by higher raw materials costs and increased facility repair and maintenance costs. Realized prices increased $61 to $748 but shipments decreased 4% to 1.3mm tons. Capacity stood at 77% (down from 89%).

- Tubular: Q3 income of $112MM, up $12MM sequentially and up $132MM YOY

- Income up due to higher average realized prices (+$63 to $1,559/ton). and decreased costs for steel substrate, which were only partially offset by slightly lower shipments (-3% to 422k tons)

- Other:Q3 income of $7MM, down $21MM sequentially and up $2MM YOY

- Down primarily due to real estate sales in Q2.

Outlook:

"Our current order entry rates reflect the uncertain economic situation in North America and Europe, with spot customers reducing inventory levels in light of short lead times, while our contractual customers' order rates are consistent with traditional downtime taken late in the fourth quarter."

Outlook By Segment:

- Flat-rolled are expected to be in line with the third quarter, expects to operate at an overall lower raw steel capability utilization rate due to lower expected shipments and realized prices;

- USSE expected to be comparable to the third quarter as lower raw materials costs and reduced spending on facility repair and maintenance are offset by lower shipments;

- Tubular segment expects to remain profitable in the fourth quarter, but expect lower results as compared to the third quarter. Customer inventory levels are at the high end of the normal range.

Value:

X 7.375 4/20 (Ba2/BB) +400/10yr

MT 5.250 8/20 (Baa3/BBB) +250/10yr

NUE 4.125 9/22 (A2/A) +132/10yr

While X presents some value to HY accounts at +400, I believe it is going lower and will have better entry spots. This sentiment can be extrapolated to the entire sector. NUE and MT have widened as well, but there should be lower entry spots. Underweight the sector.

Monday, October 25, 2010

Greece - Coulda Been a Contender

In this corner, wearing golden trunks and talking their own book:

And in the opposite corner, wearing no trunks and having no credibility or skin in the game:

Hmmm, I personally think it makes tons of sense to default and, quite frankly, Greece has a history of it.

Mohamed El-Erian, chief executive and co-chief investment officer of bond giant Pimco, said he bets Greece will default on its debt in three years.Greece is likely to default, and it will be to the country's and the European Union's benefits, said El-Erian, speaking at the Buttonwood Gathering in New York. Without an orderly restructuring, he said, Greece's economy could spiral into a lost decade of high unemployment and low growth as seen in Asia and Latin America in the past.

That is because the fiscal plan imposed by the International Monetary Fund and EU for Greece's bailout to adjust its debt to GDP ratio will require enormous growth sacrifices, and yet see the country's debt rise further into the future.

"Europe has shown its ability to make changes that people thought were not very likely," said El-Erian. He said it is in the region's interest for Greece to default "because the alternative doesn't promise growth and employment generation."

And in the opposite corner, wearing no trunks and having no credibility or skin in the game:

Deven Sharma, president of Standard & Poor's, said Greece will not default Monday. "I do not believe Greece will default," said Sharma, speaking at The Buttonwood Gathering in New York. "The design always was for there to be a collective solution" in the European Union, he said.

Hmmm, I personally think it makes tons of sense to default and, quite frankly, Greece has a history of it.

Gymboree - Welcome to the World of Leverage

On the wire:

Hey Gymboree, welcome to the world of crap balance sheets. Hope it works out for you as thus far leveraged retain buyouts have been miserable failures.

Gymboree Corp., the children’s clothing retailer being taken private by Bain Capital LLC, is seeking $1.47 billion of loans to pay for its leveraged buyout.

Credit Suisse Group AG and Morgan Stanley agreed to provide a $720 million term loan maturing in seven years and a one-year, $520 million senior unsecured bridge facility with an increasing interest rate, according to a commitment letter Gymboree attached today to a regulatory filing. Bank of America Corp. is arranging a $225 million asset-based revolving credit line due in five years as part of the financing package.

Bain agreed to purchase the San Francisco-based retailer for $65.40 a share, according to an Oct. 11 statement, paying a 57 percent premium. That’s the biggest retail-apparel leveraged buyout in three years, according to data compiled by Bloomberg. The Boston-based private-equity firm will fund about 70 percent of the $1.8 billion acquisition with debt, the filing shows.

Hey Gymboree, welcome to the world of crap balance sheets. Hope it works out for you as thus far leveraged retain buyouts have been miserable failures.

Berkshire's Continuing Stream of Nonsense

Warren Buffett's company is defending its decision not to write down the value of its investments in Kraft Foods, US Bancorp and other stocks even though they were worth nearly $1.9 billion less at the end of 2009 than what Berkshire Hathaway Inc. paid for them.

On Monday, Berkshire disclosed several letters it exchanged with the Securities and Exchange Commission between April and September about its 2009 annual report. The SEC asked why Berkshire hadn't adjusted the value of its stock holdings to reflect losses that had lasted more than 12 months.

Berkshire officials said they're confident Kraft and US Bancorp stock will rebound within a couple years, and Berkshire is willing to hold the stocks long enough for them to recover.

Seriously?

Can we all use this approach? I am thinking we can't. Typical Berkshire nonsense.

On Monday, Berkshire disclosed several letters it exchanged with the Securities and Exchange Commission between April and September about its 2009 annual report. The SEC asked why Berkshire hadn't adjusted the value of its stock holdings to reflect losses that had lasted more than 12 months.

Berkshire officials said they're confident Kraft and US Bancorp stock will rebound within a couple years, and Berkshire is willing to hold the stocks long enough for them to recover.

Seriously?

Can we all use this approach? I am thinking we can't. Typical Berkshire nonsense.

Friday, October 22, 2010

Unexploited Investment Ideas

On the wire:

Two unexploited markets:

Lunar real estate (residential at first, commercial later) - I smell a Moon REIT;

Bottled water - would expect KO is looking at the Dasani profits and thinking galactically instead of globally.

Have a great Day

There is a lot more water on the moon than previously believed, according to an analysis of NASA data being published Friday, a finding that may bolster the case for a manned base on the lunar surface.

The discovery grew out of an audacious experiment last year, when the National Aeronautics and Space Administration slammed a spent-fuel rocket into a lunar crater at 5,600 miles an hour, and then used a pair of orbiting satellites to analyze the debris thrown off by the impact. They discovered that the crater contained water in the form of ice, plus a host of other resources, including hydrogen, ammonia, methane, mercury, sodium and silver.

Finding a water source on the moon has long been a dream, because it could save on the expense of transporting it from earth. A bottle of water on the moon would run about $50,000, according to NASA, because that is what it costs, per pound, to launch anything to earth's nearest neighbor.

Two unexploited markets:

Lunar real estate (residential at first, commercial later) - I smell a Moon REIT;

Bottled water - would expect KO is looking at the Dasani profits and thinking galactically instead of globally.

Have a great Day

Dover Earnings and Value

Dover (A2/A) released earnings that can be considered strong and raised guidance for the full year. Credit metrics are strong and ratings are secure. While bookings were somewhat weaker sequentially (primarily seasonal), all other metrics were stronger and growth (coupled with a conservative financial approach) should continue to strengthen metrics.

Stats:

Revenues (Q) $1.9B +26% (25% organic)

Revenue YTD$5.3B + 23%;

EBITDA TTM $1.7B

Margins up across all segments YTD;

Net earnings (Q) $223.8MM;

Net earnings (YTD) $501.8MM;

FCF (Q) $157.3MM;

Total Debt $1.839B vs $1.86B YE

Working capital was a net consumer of cash for the quarter.

Bookings: order rates increased 27% (YoY) book-to-bill of 0.96; Sequential bookings were lower across all segements except electronic technologies. Weakest sequential bookings took place within mobile equipment and engineered products.;

Backlog of $1.3B

Net debt / capital: 14.8% vs 18.4% YE '09- lower debt and higher cash.

Debt / Capital: 29% vs 31% YE '09

Debt/EBITDA: 1.03x

Cash: $866MM vs $714MM 12/09

DOV estimates full year revenue growth will be 20%-21% (organic growth of 16.5%-17.5%). Co expects that FCF will equal 10% of revenues.

Value:

DOV 4.875 '15 +73/5yr A2/A

DOV '18 +40/30 10yr A2/A

ITW 6.25 '19 +70/10yr A1/A+

Hubbell 5.95 '18 +63/10y A3/A

Better buyer of ITW or Hubbellat these levels. Both can be somewhat scarce.

Stats:

Revenues (Q) $1.9B +26% (25% organic)

Revenue YTD$5.3B + 23%;

EBITDA TTM $1.7B

Margins up across all segments YTD;

Net earnings (Q) $223.8MM;

Net earnings (YTD) $501.8MM;

FCF (Q) $157.3MM;

Total Debt $1.839B vs $1.86B YE

Working capital was a net consumer of cash for the quarter.

Bookings: order rates increased 27% (YoY) book-to-bill of 0.96; Sequential bookings were lower across all segements except electronic technologies. Weakest sequential bookings took place within mobile equipment and engineered products.;

Backlog of $1.3B

Net debt / capital: 14.8% vs 18.4% YE '09- lower debt and higher cash.

Debt / Capital: 29% vs 31% YE '09

Debt/EBITDA: 1.03x

Cash: $866MM vs $714MM 12/09

DOV estimates full year revenue growth will be 20%-21% (organic growth of 16.5%-17.5%). Co expects that FCF will equal 10% of revenues.

Value:

DOV 4.875 '15 +73/5yr A2/A

DOV '18 +40/30 10yr A2/A

ITW 6.25 '19 +70/10yr A1/A+

Hubbell 5.95 '18 +63/10y A3/A

Better buyer of ITW or Hubbellat these levels. Both can be somewhat scarce.

Verizon Earnings and Value

Verizon Earnings:

Earnings from Verizon were released today. EPS (adjusted) beat by $0.02. Debt metrics remain decent and supportive of ratings. Like the name and the credit.

Stats:

Consolidated

Operating revenues +2.1% YOY to $26,484MM (Analysts had expected revenue of $26.3 billion);

EBITDA ($7,769MM) +4% YoY ($25,874MM TTM);

CFO $8,340MM, down 7% from Q3 '09 ($25.2 billion in CFO year-to-date);

Net Income $881MM (down 25% YoY) excluding non-controlling interests. Including NCI $2.9B +1% YoY;

Debt $53,170 - down $4.3B from Q2 '10;

Capex $4,185MM ($11.8 billion YTD);

FCF YTD $9.3B (up $3B from '09)

Debt/EBITDA: 2.05x

Net Debt / EBITDA:

Debt/Capital: 39%

Debt/Capital excl non-controlling interests: 52%

Wireline

Operating revenues -3.6% YOY to $10,286MM.

EBITDA ($2,164) -4.5% YOY

Access lines lost 594k since 6/30 or -8.5% YOY

Strong FiOS internet and Tv adds (+226k and 224k respectively)

Wireless

Operating Revenues up 4.4% YOY to $15,697MM;

EBITDA ($6,510) +9.0% YOY;

Customer adds +1.4MM;

Churn 1.25%, down from 1.36% Q2 '10;

ARPU: $50.35 up QoQ but down 1% YOY;

Smartphone penetration +3% QoQ;

Value:

VZ 6.125 '12 +65/2y (Baa1/A - MD)

VZ 5.500 '18 +47/10yr (A3/A - communications)

VZ 6.250 '37 +149/ (A3/A - communications)

T 8.000 '31 +150/olb (A2/A)

T 5.200 '14 +70/5YR (A2/A)

T 5.600 '18 +35/10YR (A2/A)

Verizon is priced on the screws versus higher rated T but has iPhone upside as a plus and the perpetual VOD JV as an uncertain factor. Stable credit in a stable credit space. Would be market weight on the name and potentially tilt to shorter opco names (despite the continued falloff in wirelines).

Earnings from Verizon were released today. EPS (adjusted) beat by $0.02. Debt metrics remain decent and supportive of ratings. Like the name and the credit.

Stats:

Consolidated

Operating revenues +2.1% YOY to $26,484MM (Analysts had expected revenue of $26.3 billion);

EBITDA ($7,769MM) +4% YoY ($25,874MM TTM);

CFO $8,340MM, down 7% from Q3 '09 ($25.2 billion in CFO year-to-date);

Net Income $881MM (down 25% YoY) excluding non-controlling interests. Including NCI $2.9B +1% YoY;

Debt $53,170 - down $4.3B from Q2 '10;

Capex $4,185MM ($11.8 billion YTD);

FCF YTD $9.3B (up $3B from '09)

Debt/EBITDA: 2.05x

Net Debt / EBITDA:

Debt/Capital: 39%

Debt/Capital excl non-controlling interests: 52%

Wireline

Operating revenues -3.6% YOY to $10,286MM.

EBITDA ($2,164) -4.5% YOY

Access lines lost 594k since 6/30 or -8.5% YOY

Strong FiOS internet and Tv adds (+226k and 224k respectively)

Wireless

Operating Revenues up 4.4% YOY to $15,697MM;

EBITDA ($6,510) +9.0% YOY;

Customer adds +1.4MM;

Churn 1.25%, down from 1.36% Q2 '10;

ARPU: $50.35 up QoQ but down 1% YOY;

Smartphone penetration +3% QoQ;

Value:

VZ 6.125 '12 +65/2y (Baa1/A - MD)

VZ 5.500 '18 +47/10yr (A3/A - communications)

VZ 6.250 '37 +149/ (A3/A - communications)

T 8.000 '31 +150/olb (A2/A)

T 5.200 '14 +70/5YR (A2/A)

T 5.600 '18 +35/10YR (A2/A)

Verizon is priced on the screws versus higher rated T but has iPhone upside as a plus and the perpetual VOD JV as an uncertain factor. Stable credit in a stable credit space. Would be market weight on the name and potentially tilt to shorter opco names (despite the continued falloff in wirelines).

Weekly Fund Flows - October 20, 2010

Positive inflows continued this past week into all major asset classes with the exception of money markets, which saw an outflow of $17 billion, or -0.70% of assets.

- High Grade +$471 million, or 0.10% of assets.

- High Yield +$347 million, or0.30% of assets.

- Bank Loans +$290 million, or 1.20% of assets.

- EM Debt continues unabated with inflows of $202 million,or 1.20% of assets.

- Equities and Commodities saw sparse inflows.

Thursday, October 21, 2010

Week ahead for US Debt

Week ahead for Govvies:

Monday: $29 billion in 13-week bills and $28 billion in 26-week bills;

Tuesday: $35 billion in two-year notes (same as last month)

Wednesday: $35 billion in five-year notes (same as last month)

Thursday: $29 billion in seven-year notes (same as last month)

Friday: and on the fifth day, the Treasury took a rest - and it was good (more time for POMO).

Will trade for rare earth.

Monday: $29 billion in 13-week bills and $28 billion in 26-week bills;

Tuesday: $35 billion in two-year notes (same as last month)

Wednesday: $35 billion in five-year notes (same as last month)

Thursday: $29 billion in seven-year notes (same as last month)

Friday: and on the fifth day, the Treasury took a rest - and it was good (more time for POMO).

Will trade for rare earth.

Credit Markets - Its All Good

On the tape:

Disclosure: Long LQD among other credit instruments

The number of bond issuers that are at risk of being downgraded to junk territory decreased by one in the past month to 55 world-wide, according to Standard & Poor's Ratings Services.

S&P's ratings of BB+ or lower are considered junk status.

Ten entities on the verge of moving to junk territory come from the banking sector, followed by transportation and consumer products, with six each. Hungary remains the largest potential entity at risk of downgrade to junk territory.

S&P said Thursday that in the past month U.K.-based Tomkins Finance PLC became the 14th company whose ratings were cut to junk status.

Meanwhile, 23 companies have been upgraded to investment-grade territory this year because the credit environment continues to improve, according to S&P.Let the credit rally continue! Damn the financials, full speed ahead! Relative spreads are still decent, balance sheets are strong, the Fed's just giving it away and retail continues to jump on the bandwagon! Giddyup!

Disclosure: Long LQD among other credit instruments

Thursday Market Recap

Well, its Thursday and I find myself sitting here trying to digest what happened today so I can try to piece it together, make sense of it and try to fit it into a macro picture. Why? I am not sure, for myself and my book, obviously but beyond that I hear/read nothing from anyone out there as to their thoughts. So much for the collective wisdom of markets (yes, getting somewhat disheartened by the lack of response/comments). In any event, lets begin.

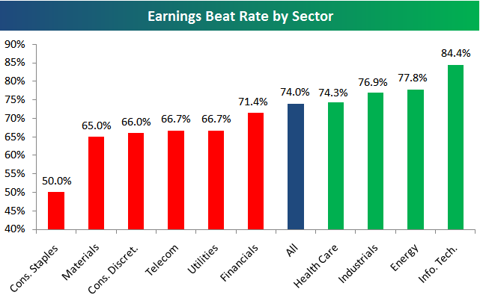

Equities:

Equities had a mixed day, starting out strong, then rolling over as the dollar strengthened. The overall trend of the market continues to be higher, but the test will be the April highs (1220 on S&P, 122 on SPY). Would not be surprised if we tested the highs again (financials willing) as earnings have been decent and a bullish undertone seems to be in place. A lot could depend on the nature and amount of QE2, which is baked in the cake. I am not sure the Fed/Treasury could pull out now if they wanted to as the market would roll over and the "stocks go up always" policy objective would fail going into elections (keep an eye on the elections).

Here's a snapshot of the US equities markets today:

And a little longer term perspective (longer term in market eyes - trading, not investor):

A little more positive conviction will get us to the test point, beyond which I am not sure how we go much higher unless we see multiple expansion as earnings expansion does not seem to be in place (have you seen some of the guidance by the bigger firms?).

As for the international markets (well, to me anyhow) we saw the same type of action we saw in the states, with continental Europe outperforming. Commodity currency countries were somewhat weak - although Australia is in the green as I write.

I am still somewhat nervous over Brazil, their market was down today and I can't overlook the increase in CDS being bought on the sovereign.

In any event, here is the capitalization chart:

Gee, midcaps still leading the pack? We are not surprised, are we?

And growth Value:

Growth, really?

Okay all, I realize I skipped fixed income and currencies (yeah, I know, on the day of the $1.5B EBAY deal too), but a fella has to know when his time is up - at least for the day. Be sure to check out Seeking Alpha for more posts (although the blog has been getting the lions share).

Good luck, lets be careful out there.

Equities:

Equities had a mixed day, starting out strong, then rolling over as the dollar strengthened. The overall trend of the market continues to be higher, but the test will be the April highs (1220 on S&P, 122 on SPY). Would not be surprised if we tested the highs again (financials willing) as earnings have been decent and a bullish undertone seems to be in place. A lot could depend on the nature and amount of QE2, which is baked in the cake. I am not sure the Fed/Treasury could pull out now if they wanted to as the market would roll over and the "stocks go up always" policy objective would fail going into elections (keep an eye on the elections).

Here's a snapshot of the US equities markets today:

And a little longer term perspective (longer term in market eyes - trading, not investor):

A little more positive conviction will get us to the test point, beyond which I am not sure how we go much higher unless we see multiple expansion as earnings expansion does not seem to be in place (have you seen some of the guidance by the bigger firms?).

As for the international markets (well, to me anyhow) we saw the same type of action we saw in the states, with continental Europe outperforming. Commodity currency countries were somewhat weak - although Australia is in the green as I write.

I am still somewhat nervous over Brazil, their market was down today and I can't overlook the increase in CDS being bought on the sovereign.

In any event, here is the capitalization chart:

Gee, midcaps still leading the pack? We are not surprised, are we?

And growth Value:

Growth, really?

Okay all, I realize I skipped fixed income and currencies (yeah, I know, on the day of the $1.5B EBAY deal too), but a fella has to know when his time is up - at least for the day. Be sure to check out Seeking Alpha for more posts (although the blog has been getting the lions share).

Good luck, lets be careful out there.

NextEra Energy - More News, Little Value

Some news on Florida Power & Light (NEE -A/Baa1):

Personally, I don't think FPL will have a favorable outcome until Skop is gone and they present a realistic rate case. Trying to blackmail the PUC with threats of stopping expansion is hardly a business plan.

I am not a big fan of the new regulatory environment in Florida and the relationship between NEE and the regulator.

NEE '19s trade 120/110

35s trade 103/olb

more or less on the screws - Don't see real value here.

TALLAHASSEE -The 1st District Court of Appeal has denied Florida Power & Light Company's request for an emergency order to allow the Florida Public Service Commission to hear the company's issues without Commissioner Nathan Skop.

The denial issued late Wednesday means that an automatic stay on FPL matters applies to the entire four-member commission.

It appears that FPL's proposed rate case settlement and other issues on Tuesday's agenda will once again be deferred.

That could change if the court rules before Tuesday on FPL's request to bar Skop from hearing its cases, FPL spokesman Mark Bubriski said.

In September FPL asked the court to disqualify Skop, saying he cannot rule fairly when considering its business.

Skop, whose term ends in January, has blamed the fact the nominating council did not interview him for reappointment showed that "FPL owns state government. He has also said that the decision was "retaliation" and "payback" for his having voted to reject a $1.2 billion rate hike the company sought.

Personally, I don't think FPL will have a favorable outcome until Skop is gone and they present a realistic rate case. Trying to blackmail the PUC with threats of stopping expansion is hardly a business plan.

I am not a big fan of the new regulatory environment in Florida and the relationship between NEE and the regulator.

NEE '19s trade 120/110

35s trade 103/olb

more or less on the screws - Don't see real value here.

Bank of America - Let the Beating Continue

Another day, another BAC Whack-A-Mole!

Little equity snapshot:

Yeah, Hows that feel?

Lets turn to the smart money - bonds:

This morning I saw the following quote:

BAC 5 ⅝ 07/01/20 +260/25

Now I am seeing:

BAC 5.625 '20 +268

and

Ya know, the other day I caught some flak over my comment they were under-reserving for reps and warranties. Ummm, nope, appears others might think so too.

Do not touch the equity until bonds have finished getting spanked!

Little equity snapshot:

Yeah, Hows that feel?

Lets turn to the smart money - bonds:

This morning I saw the following quote:

BAC 5 ⅝ 07/01/20 +260/25

Now I am seeing:

BAC 5.625 '20 +268

and

Ya know, the other day I caught some flak over my comment they were under-reserving for reps and warranties. Ummm, nope, appears others might think so too.

Do not touch the equity until bonds have finished getting spanked!

Jobless Claims Thursday

From the release:

In the week ending Oct. 16, the advance figure for seasonally adjusted initial claims was 452,000, a decrease of 23,000 from the previous week's revised figure of 475,000 (was 462k). The 4-week moving average was 458,000, a decrease of 4,250 from the previous week's revised average of 462,250. Okay, decreased 23k from a number revised higher by 10k. Ummm, right.

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 9 was 4,441,000, a decrease of 9,000 from the preceding week's revised level of 4,450,000. The 4-week moving average was 4,478,000, a decrease of 23,250 from the preceding week's revised average of 4,501,250.

States reported 4,040,113 persons claiming EUC (Emergency Unemployment Compensation) benefits for the week ending Oct. 2, an increase of 152,112 from the prior week. There were 3,428,585 claimants in the comparable week in 2009. EUC weekly claims include first, second, third, and fourth tier activity. Okay, more folks have fallen onto the Fed's books because they have been unemployed for so long.

This is better than expected? Hardly. This just helps support the further debasement of the currency (oops, that would be an issue we are chastising China for) I mean QE2.

APD Credit Thoughts

APD earnings out (beat on equity side, credit looks stronger):

Outlook: committed to delivering 2011 targets of double digit earnings growth, improving return on capital and achieving a 17 percent operating margin." Capex will fall between $1.5 - $1.7B.

Stats:

Debt/Cap: 42% vs 44% (6/10) and 48% (9/09)

2010 CFO: $1,552; CAPEX: $1,030; Div: $398 = FCF of $124MM (vs -$223MM in 2009)

EBITDA: $2.4B vs. $1.8B '09

Debt/EBITDA: 1.7x vs 2.5x '09

The credit metrics and performance would serve to increase their ability to make the ARG acquisition happen without a significant deterioration of underlying fundamentals.

ARG 2.85 '13s +145

ARG 3.25 '15 +175

APD 4.375 '19 +95

Trade Ideas:

S ARG 13s B ARG 15s - curve is very steep.

S APD 19s B ARG 15s

- Air Products reported income from continuing operations of $294 million versus $246 million for the fourth quarter of fiscal 2009.

- Fourth quarter revenues of $2,351 million increased 10 percent versus prior year and four percent sequentially.

- Operating income of $402 million rose 22 percent versus prior year and seven percent sequentially on higher volumes across all segments. For the year, operating income was up 25% on an adjusted basis. Operating margin of 16.5%, up 220 basis points.

- Merchant Gases sales of $948 million (40% of total) up 2% yoy

- Tonnage Gases sales of $752 million (32% of total) up 17% yoy

- Electronics and Performance Materials sales of $523 million (22% of total) up 20% yoy

- Equipment and Energy sales of $128 million (5% of total) up 5% yoy

Outlook: committed to delivering 2011 targets of double digit earnings growth, improving return on capital and achieving a 17 percent operating margin." Capex will fall between $1.5 - $1.7B.

Stats:

Debt/Cap: 42% vs 44% (6/10) and 48% (9/09)

2010 CFO: $1,552; CAPEX: $1,030; Div: $398 = FCF of $124MM (vs -$223MM in 2009)

EBITDA: $2.4B vs. $1.8B '09

Debt/EBITDA: 1.7x vs 2.5x '09

The credit metrics and performance would serve to increase their ability to make the ARG acquisition happen without a significant deterioration of underlying fundamentals.

ARG 2.85 '13s +145

ARG 3.25 '15 +175

APD 4.375 '19 +95

Trade Ideas:

S ARG 13s B ARG 15s - curve is very steep.

S APD 19s B ARG 15s

Wednesday Bonds

Credit did well today with both IG and HY turning in positive advance/decline ratios of approximately 1.1x. New issue flow was muted and secondary activity kept pace with yesterday, but not much more.

The HRB 5.125% '14 opened weak at $92ish and rolled over during the day to land around $89. Oh, did I mention the downgrade? Yeah, hope those tax receipts are huge - best of luck (honestly though, the company's on the hook for the mortgages even though they were sold, but they have decent enough cash flow to cover a good chunk - but if the repurchases are larger than expected - POW). Might look at these as a value play soon - wait for them to shed more points.

Moving on....

Curve steepened a bit in 2-10s and flattened some in 10-30, the net being marginal.

Tomorrow: we get jobless claims (455k expected, 462k prior) and Philly Fed (1.40 expected, -0.7 prior), claims last week were a disappointment - wouldn't be surprised to see modest bounce - and Philly Fed forecasters are looking for uptick, just might get it.

Does it feel like a bubble to you? Me neither.

BAC continued to be in the headlines today as folks pondered the whole FRBNY/PIMCO/BLK repurchase story. Wells' earnings did nothing to help their beleaguered peer. At first bonds started to claw tighter, but couldn't keep the momentum going and slipped deeper down the well.

Looking at the BAC 5.625% 7/20:

How do you think this will fare tomorrow when folks have read - and knee-jerked to -the WSJ story stating:

The federal regulator overseeing Fannie Mae and Freddie Mac hired a law firm specializing in litigation as the agency considers how to move forward with efforts to recoup billions of dollars on soured mortgage-backed securities purchased from banks and Wall Street firms.

The Federal Housing Finance Agency, which in July issued 64 subpoenas to issuers of mortgage securities, bank servicing companies and other entities, is working with Quinn Emanuel Urquhart & Sullivan LLP, a Los Angeles-based firm that specializes in business litigation, to coordinate its investigations.

Yeah, gonna be fun for BAC holders again. On the fly, I would say BAC holders can feel fortunate they don't own H&R Block paper. H&R Block CDS rose to 768 from 722 on Tuesday and continued to bleed out today. A credit strategist focusing on U.S. banks said the company could face the same issues as Bank of America because of a legacy portfolio of mortgages from Option One Mortgage Corp., which it agreed to sell in 2008.Since the financial crisis, 400-lawyer Quinn Emanuel has avoided building a banking clientele, making it a top suitor for plaintiffs pursuing banks. The firm has represented MBIA Insurance Corp. in several lawsuits against top U.S. mortgage banks alleging that the insurer was fraudulently induced to cover losses on mortgage-backed securities. Those cases are ongoing.

The HRB 5.125% '14 opened weak at $92ish and rolled over during the day to land around $89. Oh, did I mention the downgrade? Yeah, hope those tax receipts are huge - best of luck (honestly though, the company's on the hook for the mortgages even though they were sold, but they have decent enough cash flow to cover a good chunk - but if the repurchases are larger than expected - POW). Might look at these as a value play soon - wait for them to shed more points.

Moving on....

With the dollar down, risk on trade happening today, govvies did pretty well, all things considered. Tomorrow 2yr, 5yr and 7yr get announced for auction next week.

Curve steepened a bit in 2-10s and flattened some in 10-30, the net being marginal.

Tomorrow: we get jobless claims (455k expected, 462k prior) and Philly Fed (1.40 expected, -0.7 prior), claims last week were a disappointment - wouldn't be surprised to see modest bounce - and Philly Fed forecasters are looking for uptick, just might get it.

Wednesday, October 20, 2010

More Folks With Their Heads In The Cloud

Companies are using cloud computing services more aggressively than was believed, separate surveys show.

Novell ( NOVL ), the Massachusetts-based enterprise-software company, reports this week that 77 percent of organizations with more than 2,500 employees use some form of cloud computing today. The tech executives surveyed on behalf of Novell don't expect cloud computing to supplant in-house IT, however: Eighty-seven percent of survey respondents said cloud computing will take hold as a complement to existing IT infrastructure.

"Enterprises are moving forward with cloud computing - whether in a private cloud, public cloud or in a hybrid cloud environment," Novell senior vice president Jim Ebzery said.

Small companies are likely to use cloud computing applications, too. Techaisle, an IT market research firm, reports that companies begin to use cloud computing services when they expand beyond 20 employees. As companies grow to 250-plus employees, they become more likely to move IT operations in-house - and if they continue to grow past 500 workers, they turn once again to the cloud.

Cloud applications can range from storage services to hosted infrastructure - and companies large and small are embracing the cloud programs that are available.

Novell ( NOVL ), the Massachusetts-based enterprise-software company, reports this week that 77 percent of organizations with more than 2,500 employees use some form of cloud computing today. The tech executives surveyed on behalf of Novell don't expect cloud computing to supplant in-house IT, however: Eighty-seven percent of survey respondents said cloud computing will take hold as a complement to existing IT infrastructure.

"Enterprises are moving forward with cloud computing - whether in a private cloud, public cloud or in a hybrid cloud environment," Novell senior vice president Jim Ebzery said.

Small companies are likely to use cloud computing applications, too. Techaisle, an IT market research firm, reports that companies begin to use cloud computing services when they expand beyond 20 employees. As companies grow to 250-plus employees, they become more likely to move IT operations in-house - and if they continue to grow past 500 workers, they turn once again to the cloud.

Cloud applications can range from storage services to hosted infrastructure - and companies large and small are embracing the cloud programs that are available.

Personally, I like the entire concept and functionality of cloud computing. While for many, the most prevalent example is Google docs, the field should be expected to expand. Technology must be accepted, embraced and adapted in order to compete and survive. I would love to know if anyone uses the cloud for their apps and which providers they use, but no one ever responds or comments - makes this endeavor just that much more fun - NOT.

Citi Restarts Dividends on Preferred Securities

On February 27, 2009 Citi announced the suspension of dividends on its Preferred Stock. Pursuant to the exchange offers, Citi offered to exchange up to $14,923,650,000 of its outstanding publicly-held Preferred Securities for Common Stock at a price per share of $3.25; 98% of the Preferred Stock elected to participate in the exchange offers. Dividends declared today will be paid on the Series AA, T, E and F Preferred Stock that remains outstanding.

C-M: $25.35 +$1.36 (+5.60%)

C-I: $46.00 +$2.90 (+6.73%)

Why now, you ask? Well, if they had deferred further, the preferred holders would be able to name representatives to the board

DISCLOSURE: I am long Citi preferreds

- 6.5% Non-Cumulative Convertible Preferred Stock, Series T, payable November 15, 2010, to holders of record on November 5, 2010. Holders of depositary receipts, each representing one-thousandth of a full convertible preferred share, will be paid $.8125 for each receipt held. (C-I)

- 8.125% Non-Cumulative Preferred Stock, Series AA, payable November 15, 2010, to holders of record on November 5, 2010. Holders of depositary receipts, each representing one-thousandth of a full preferred share, will be paid $.5078125 for each receipt held. (C-P)

- 8.40% Fixed Rate / Floating Rate Non-Cumulative Preferred Stock, Series E,payable November 1, 2010, to holders of record on October 20, 2010. Holders of depositary receipts, each representing one-twenty-fifth of a full preferred share, will be paid $42.00 for each receipt held.

- 8.50% Non-Cumulative Preferred Stock, Series F, payable December 15, 2010, to holders of record on December 3, 2010. Holders of depositary receipts, each representing one-thousandth of a full preferred share, will be paid $.53125 for each receipt held. (C-M)

C-M: $25.35 +$1.36 (+5.60%)

C-I: $46.00 +$2.90 (+6.73%)

Why now, you ask? Well, if they had deferred further, the preferred holders would be able to name representatives to the board

DISCLOSURE: I am long Citi preferreds

Investec Looks to Bring a Subprime Deal

(Bloomberg) Investec Plc, the South African bank, is seeking to revive the market for subprime mortgage bonds in Europe three years after the securities were blamed for the worst financial crisis since the Great Depression.

Investec is selling as much as 130 million pounds ($205 million) of top-rated five-year notes at a yield spread that’s 16 times pre-crisis levels, according to two people familiar with the deal. U.K. buy-to-let specialist Paragon Group of Cos. Plc is also preparing a sale of non-conforming mortgage bonds.

Investec’s notes may yield about 3.25 percentage points more than the London interbank offered rate, said the people, who declined to be named because the sale isn’t completed. That compares with 0.2 percentage point on non-conforming notes sold by a Lehman Brothers Holdings Inc. unit in August 2007, Europe’s last public sale of the debt, JPMorgan Chase & Co. data show.

It will be interesting to see investor reception of this type of deal. While risk appetite is in place, housing prices and trends don't help and burned investors are still working through the issues they have. Would you hit them at L+325? That said, if the bonds are tranched right and modeled under severe conditions, they might have some value.

Investec is selling as much as 130 million pounds ($205 million) of top-rated five-year notes at a yield spread that’s 16 times pre-crisis levels, according to two people familiar with the deal. U.K. buy-to-let specialist Paragon Group of Cos. Plc is also preparing a sale of non-conforming mortgage bonds.

Investec’s notes may yield about 3.25 percentage points more than the London interbank offered rate, said the people, who declined to be named because the sale isn’t completed. That compares with 0.2 percentage point on non-conforming notes sold by a Lehman Brothers Holdings Inc. unit in August 2007, Europe’s last public sale of the debt, JPMorgan Chase & Co. data show.

It will be interesting to see investor reception of this type of deal. While risk appetite is in place, housing prices and trends don't help and burned investors are still working through the issues they have. Would you hit them at L+325? That said, if the bonds are tranched right and modeled under severe conditions, they might have some value.

Rare Earth getting Rarer

From the NYT:

Finding ways to play the rare earth sector is difficult, one could look at Molycorp (MCP), General Moly (GMO), or Thomson Creek Metals (TC).

I am nervous on MCP due to the run-up it has had and the fact that their mountain pass mine will not begin production until 2012 (many a slip twixt cup and lip). Like TC, but it has languished and have to learn more about GMO - would appreciate any feedback on the name.

China, which has been blocking shipments of crucial minerals to Japan for the last month, has now quietly halted some shipments of those materials to the United States and Europe, three industry officials said this week.

The signals of a tougher Chinese trade stance come after American trade officials announced on Friday that they would investigate whether China was violating World Trade Organization rules by subsidizing its clean energy exports and limiting clean energy imports. The inquiry includes whether China’s steady reductions in rare earth export quotas since 2005, along with steep export taxes on rare earths, are illegal attempts to force multinational companies to produce more of their high-technology goods in China.

Despite a widely confirmed suspension of rare earth shipments from China to Japan, now nearly a month old, Beijing has continued to deny that any embargo exists.

Industry executives and analysts have interpreted that official denial as a way to wield an undeclared trade weapon without creating a policy trail that could make it easier for other countries to bring a case against China at the World Trade Organization.rest of story here: NYT on Rare Earth

Finding ways to play the rare earth sector is difficult, one could look at Molycorp (MCP), General Moly (GMO), or Thomson Creek Metals (TC).

I am nervous on MCP due to the run-up it has had and the fact that their mountain pass mine will not begin production until 2012 (many a slip twixt cup and lip). Like TC, but it has languished and have to learn more about GMO - would appreciate any feedback on the name.

Wells Fargo - Initial Thoughts and Stats

Some Stats:

All in all, a decent quarter, somewhat surprised at the small mortgage repurchase volume (have to wait for that part of the call to get the assumptions). For the most part, all segments of the bank are producing positive returns. Results should help lift financials.

Bonds holding in well. Think bonds are rich versus peers:

WFC 5¾ '18 120/115

JPM 4.4 '20 181/176

GS 6 '20 213/208

Seller of WFC > JPM.

- Tier 1 common equity of 8%, up 40bps QOQ and 280bps YOY;

- Tier 1 Capital of 10.9%, up 40bps QOQ and 30bps YOY;

- Net charge-offs as % of avg. total loans 2.14% vs 2.33% 6/30;

- NIM 4.25%, down 13bps sequentially and 11bps YOY;

- Revenue of $20.9 billion; pre-tax pre-provision profit of $8.6 billion

- Record net income of $3.34 billion; $21.2 billion of cumulative net income since Wachovia merger closed December 31, 2008;

- Net loan charge-offs of $4.1 billion, down $394 million, or 9 percent from prior quarter, down $1.3 billion, or 24 percent, from fourth quarter 2009 peak;

- Commercial and commercial real estate nonperforming loans were up approximately $400 million from

the second quarter. - Reserve release of $650 million (pre tax) reflecting improved portfolio performance;

- Credit losses continued to trend down, with net charge-offs declining 9 percent linked quarter, and down $1.3 billion, or 24 percent, from the peak in fourth quarter 2009. Allowance for credit losses equal to 150 percent of annualized net charge-offs;

- Foreclosed assets were $6.1 billion at September 30, 2010, up $1.1 billion from second quarter of which

$509 million was due to transfers from PCI portfolios, and $148 million from an increase in fully insured

GNMA loans. - ROA 1.09% - +6bps yoy

- During the quarter, the Company provided $370 million for mortgage loan repurchase losses compared

with $382 million in second quarter (included in revenue from mortgage loan origination/sales activities).

The lower provision this quarter reflected a decline in demands from agencies on the 2006-2008 vintages

and lower total outstanding demands as the Company continues to work with investors to resolve the

outstanding demand pipeline.

All in all, a decent quarter, somewhat surprised at the small mortgage repurchase volume (have to wait for that part of the call to get the assumptions). For the most part, all segments of the bank are producing positive returns. Results should help lift financials.

Bonds holding in well. Think bonds are rich versus peers:

WFC 5¾ '18 120/115

JPM 4.4 '20 181/176

GS 6 '20 213/208

Seller of WFC > JPM.

Thought for The Day

What Darwin was too polite to say, my friends, is that we came to rule the Earth not because we were the smartest, or even the meanest, but because we have always been the craziest, most murderous motherf@#kers in the jungle. - Stephen King

And so it begins.

And so it begins.

Tuesday, October 19, 2010

BAC - If It Was Attractive Before...

Kinda made me laugh:

Gee, if it was attractive before, its getting really attractive now (courtesy NASDAQ).

Dipped my toe in the BAC equity water (already own BML preferreds) and quickly went underwater. Fortunately, I tend to leg into the falling knives. I also believe that it is a decent long-term play (and yes, I bought it with that intention being a value/credit guy).

Gee, if it was attractive before, its getting really attractive now (courtesy NASDAQ).

Dipped my toe in the BAC equity water (already own BML preferreds) and quickly went underwater. Fortunately, I tend to leg into the falling knives. I also believe that it is a decent long-term play (and yes, I bought it with that intention being a value/credit guy).

Net Notional CDS Protection - Changes in the Top 10

Today I thought we would look at where folks are adding protection (buying protection, long CDS) over the last month. Keep in mind that the data is a week old (the newest DTCC will give folks like me). Here goes:

One month ago:

Italy is taking top honors, followed up by Germany, Spain, Brazil then France. Fast forward to October 8th:

Top 5 names remain the same, but the UK jumps ahead of CDS on loans. Fast forward to October 15th:

Top 5 are still the same, but Brazil jumps 2 slots to edge out Germany.

Now I ask you, where are folks betting there will be trouble?

I found this exercise interesting, did you?

One month ago:

Italy is taking top honors, followed up by Germany, Spain, Brazil then France. Fast forward to October 8th:

Top 5 names remain the same, but the UK jumps ahead of CDS on loans. Fast forward to October 15th:

Top 5 are still the same, but Brazil jumps 2 slots to edge out Germany.

Now I ask you, where are folks betting there will be trouble?

I found this exercise interesting, did you?

Bank of America - Mortgage Data (Reps and Warranties)

BAC released earnings this morning (they beat) and rather than focus on the earnings and the segment revs and earnings, I wanted to address the reps and warranties issues (aka the mortgage mess).

From the investor presentation (full presentation here: BAC Investor Presentation);

Outstanding claims increased by $1.7B from Q2 to Q3. The pace of growth slowed due to a slowdown in monoline claims.

Now that we have a claim number (or a snapshot of 9/30s claim number), lets look at what they have reserved for these claims:

The provision for reps and warranties has dropped due to a reduction in monoline provisioning. Using these numbers, BAC is holding about 30% of the claims in reserves.

Whole Loan Investors/Private Label Securitizations

$3.9 billion of repurchase claims received through 9/30/10; $1.0 billion remain outstanding of which $0.5 billion already reviewed and declined to repurchase; Approximately $1.0 billion approved for repurchase.

This seems to point to a repurchase rate of approximately 50%. Claims received to date equate to approximately 86bps of the outstanding balance thus far.

Private Label Securities wrapped by monolines

As of 9/30/10, $4.8B of repurchase claims received; $4.2B remain outstanding of which $2.7B already reviewed and declined to repurchase; Approximately $550M approved for repurchase.

It looks like a "declined" rate of around 65%, will probably head higher, lets call it a 70% "declined" rate, which should imply a 30% "approved" rate. As an aside, the claims equate to approximately 6% of outstanding loans.

$1.2T loans sold to GSE's, $18B of claims received to date (1.5%). Does 30% provisioning rate seem enough? No, it doesn't.

From the investor presentation (full presentation here: BAC Investor Presentation);

Outstanding claims increased by $1.7B from Q2 to Q3. The pace of growth slowed due to a slowdown in monoline claims.

Now that we have a claim number (or a snapshot of 9/30s claim number), lets look at what they have reserved for these claims:

The provision for reps and warranties has dropped due to a reduction in monoline provisioning. Using these numbers, BAC is holding about 30% of the claims in reserves.

Whole Loan Investors/Private Label Securitizations

$3.9 billion of repurchase claims received through 9/30/10; $1.0 billion remain outstanding of which $0.5 billion already reviewed and declined to repurchase; Approximately $1.0 billion approved for repurchase.

This seems to point to a repurchase rate of approximately 50%. Claims received to date equate to approximately 86bps of the outstanding balance thus far.

Private Label Securities wrapped by monolines

As of 9/30/10, $4.8B of repurchase claims received; $4.2B remain outstanding of which $2.7B already reviewed and declined to repurchase; Approximately $550M approved for repurchase.

It looks like a "declined" rate of around 65%, will probably head higher, lets call it a 70% "declined" rate, which should imply a 30% "approved" rate. As an aside, the claims equate to approximately 6% of outstanding loans.

$1.2T loans sold to GSE's, $18B of claims received to date (1.5%). Does 30% provisioning rate seem enough? No, it doesn't.

Monday, October 18, 2010

SPY Flash Crash - or Not

Interesting tidbit about the after-hours action:

Bloomberg:

SEC Rules:

The circuit breaker pilot program was approved in June in response to the market disruption of May 6 and currently applies to stocks listed in the S&P 500 Index. Trading in a security included in the program is paused for a five-minute period if the security experiences a 10 percent price change over the preceding five minutes. The pause gives the markets an opportunity to attract new trading interest in an affected stock, establish a reasonable market price, and resume trading in a fair and orderly fashion. The circuit breaker program is in effect on a pilot basis through Dec. 10, 2010.

For stocks that are subject to the circuit breaker program, trades will be broken at specified levels depending on the stock price:

Bloomberg:

A software update at NYSE Euronext’s Arca platform triggered what appeared to be a 9.6 percent plunge in an exchange-traded fund that tracks the Standard & Poor’s 500 Index, a drop that would have erased $7.9 billion from one of the most popular securities in the U.S.Data published by the electronic venue at 4:15 p.m. New York time showed the SPDR S&P 500 ETF Trust at $106.46 compared with its opening price of $117.74. The apparent plunge in price involved 7.2 million shares in the closing auction on NYSE Arca, according to data compiled by Bloomberg at 4:30 p.m. The S&P 500 rose 0.7 percent to close at 1,184.71 today.

NYSE Arca will “bust” all the $106.46 trades, according to an e-mail from exchange spokesman Raymond Pellecchia.Some in the "sphere" posited:

These trades shouldn't have been broken at all according the the SEC rules. The circuit breaker should kick in at a 10% move, about $106.80, but the trades should not be broken unless trades were 3% below that, about $103.24 (calculated from the day's high of $118.67).

SEC Rules:

The circuit breaker pilot program was approved in June in response to the market disruption of May 6 and currently applies to stocks listed in the S&P 500 Index. Trading in a security included in the program is paused for a five-minute period if the security experiences a 10 percent price change over the preceding five minutes. The pause gives the markets an opportunity to attract new trading interest in an affected stock, establish a reasonable market price, and resume trading in a fair and orderly fashion. The circuit breaker program is in effect on a pilot basis through Dec. 10, 2010.

For stocks that are subject to the circuit breaker program, trades will be broken at specified levels depending on the stock price:

- For stocks priced $25 or less, trades will be broken if the trades are at least 10 percent away from the circuit breaker trigger price.

- For stocks priced more than $25 to $50, trades will be broken if they are 5 percent away from the circuit breaker trigger price.

- For stocks priced more than $50, the trades will be broken if they are 3 percent away from the circuit breaker trigger price.

Monday Market Recap

Monday already. Market has a mixed tone as Citi beat, Apple guidance disappoints, Rio and BHP call it a day for their JV and Walmart brings a megadebt offering. Nothing occurring today that changes my outlook on the markets. Liked the IP number today (for the trend if nothing else), bank mess seems manageable (ugly, but manageable), Europe was quiet (well, Europe ex France) and political market commentary was somewhat muted. Still long midcap growth (VOT) with a mild small cap exposure (IJR), bonds (AGG) - with a corporate tilt (LQD) and short long treasuries (TBT), own preferred through closed ends (JPS, PFD) and continue to like C$ and A$.

How about a couple numbers:

Equities:

S&P is posting stale data, so lets move to a different source (yep, Google):

Summary:

And a little sector action:

Financials found their legs today with Citi's earnings, Basic materials took it on the chin with the breakup of the BHP/RIO ore JV, healthcare just continues to motor along.

Growth/Value:

Value steeling some of growth's thunder in midcap space (IWS = midcap val, IWP=midcap growth).

Small cap eating up midcap's advantage (IWO= smallcap Growth). Keep your eye on this. Combine the two and...

BOOM, smallcap value (IWN=smallcap value) making its move. I think it is too early for this to stick, but I will be keeping my eye on it.

Fixed Income:

Mr. Rollback borrows $5B from the markets today. They buy everything cheap.

IG finally had an up breadth day with advancers leading decliners by 1.38x, but with lower volume. HY barely held on to a positive adv/decl ratio, turning in a 1.01x on lower volume.

Curve steepening brought to you by stronger belly of the curve. Still like the steepener trade.

Forex:

Uncle sam gains some ground (as of writing after giving some turf earlier. QE2 is not going to allow for much gain here.

Errata:

Bank of America announced on Monday that it would resume home foreclosures in nearly two dozen states, despite the running controversy over how banks handled tens of thousands of cases of homeowners facing eviction. Bank of America, the nation’s largest bank and the servicer of roughly one in five American mortgages, insisted that it had not found a single example where a foreclosure proceeding was brought in error.

Bank of America said it would resume foreclosures in the 23 states where judicial approval was required after an internal review turned up no evidence that cases were filed in error. However, Bank of America’s suspension will remain in effect in the 27 other states that do not require a judge’s approval to foreclose, as the bank’s paperwork review proceeds state by state. It was the only bank to initiate a nationwide freeze.Not the end of this issue, not at all.

The Journal found that all of the 10 most popular apps on Facebook were transmitting users' IDs to outside companies. The apps, ranked by research company Inside Network Inc. (based on monthly users), include Zynga Game Network Inc.'s FarmVille, with 59 million users, and Texas HoldEm Poker and FrontierVille. Three of the top 10 apps, including FarmVille, also have been transmitting personal information about a user's friends to outside companies. The information being transmitted is one of Facebook's basic building blocks: the unique "Facebook ID" number assigned to every user on the site. Since a Facebook user ID is a public part of any Facebook profile, anyone can use an ID number to look up a person's name, using a standard Web browser, even if that person has set all of his or her Facebook information to be private. For other users, the Facebook ID reveals information they have set to share with "everyone," including age, residence, occupation and photos. You can't be paranoid enough.

Good luck, lets be careful out there.

How about a couple numbers:

Equities:

S&P is posting stale data, so lets move to a different source (yep, Google):

Summary:

And a little sector action:

Financials found their legs today with Citi's earnings, Basic materials took it on the chin with the breakup of the BHP/RIO ore JV, healthcare just continues to motor along.

Growth/Value:

Value steeling some of growth's thunder in midcap space (IWS = midcap val, IWP=midcap growth).

Small cap eating up midcap's advantage (IWO= smallcap Growth). Keep your eye on this. Combine the two and...

BOOM, smallcap value (IWN=smallcap value) making its move. I think it is too early for this to stick, but I will be keeping my eye on it.

Fixed Income:

Mr. Rollback borrows $5B from the markets today. They buy everything cheap.

IG finally had an up breadth day with advancers leading decliners by 1.38x, but with lower volume. HY barely held on to a positive adv/decl ratio, turning in a 1.01x on lower volume.

Curve steepening brought to you by stronger belly of the curve. Still like the steepener trade.

Forex:

Uncle sam gains some ground (as of writing after giving some turf earlier. QE2 is not going to allow for much gain here.

Errata:

Bank of America announced on Monday that it would resume home foreclosures in nearly two dozen states, despite the running controversy over how banks handled tens of thousands of cases of homeowners facing eviction. Bank of America, the nation’s largest bank and the servicer of roughly one in five American mortgages, insisted that it had not found a single example where a foreclosure proceeding was brought in error.

Bank of America said it would resume foreclosures in the 23 states where judicial approval was required after an internal review turned up no evidence that cases were filed in error. However, Bank of America’s suspension will remain in effect in the 27 other states that do not require a judge’s approval to foreclose, as the bank’s paperwork review proceeds state by state. It was the only bank to initiate a nationwide freeze.Not the end of this issue, not at all.

The Journal found that all of the 10 most popular apps on Facebook were transmitting users' IDs to outside companies. The apps, ranked by research company Inside Network Inc. (based on monthly users), include Zynga Game Network Inc.'s FarmVille, with 59 million users, and Texas HoldEm Poker and FrontierVille. Three of the top 10 apps, including FarmVille, also have been transmitting personal information about a user's friends to outside companies. The information being transmitted is one of Facebook's basic building blocks: the unique "Facebook ID" number assigned to every user on the site. Since a Facebook user ID is a public part of any Facebook profile, anyone can use an ID number to look up a person's name, using a standard Web browser, even if that person has set all of his or her Facebook information to be private. For other users, the Facebook ID reveals information they have set to share with "everyone," including age, residence, occupation and photos. You can't be paranoid enough.

Good luck, lets be careful out there.

Industrial Production - Its not the Number, Its the Trend

IP and CU released today. Below estimates but look closer and skip the data point to data point nonsense.

Industrial production decreased 0.2 percent in September after having increased 0.2 percent in August. The indexes both for manufacturing and for manufacturing excluding motor vehicles and parts also moved down 0.2 percent in September.

The index for manufacturing decelerated sharply in the third quarter: After having jumped at an annual rate of 9.1 percent in the second quarter, factory output gained 3.6 percent in the third quarter. At 93.2 percent of its 2007 average, total industrial production in September was 5.4 percent above its year-earlier level.

The capacity utilization rate for total industry edged down to 74.7 percent, a rate 4.2 percentage points above the rate from a year earlier but 5.9 percentage points below its average from 1972 to 2009.

Capacity Utilization looks better to me, no?

And industrial production: